In recent years, the discourse surrounding climate change has been inundated with the concept of carbon credits and offsets. These mechanisms, ostensibly designed to mitigate the carbon footprints of corporations and individuals, present a paradoxically complex picture. While they are lauded as innovative solutions in the fight against global warming, there lurks a consequential reality: carbon piracy. This term captures the troubling activities surrounding carbon trading, where the intended benefits are often subverted, leading to ethical quandaries and environmental injustices. What unfolds, therefore, is a narrative of promises betrayed and the urgent need for a paradigm shift in how society perceives and engages with carbon markets.

At the heart of the carbon trading system lies the idea that companies can offset their greenhouse gas emissions by investing in environmental projects—like reforestation or renewable energy—elsewhere. Carbon credits function as a currency within this framework, allowing entities to buy and sell their emissions allowances. This may appear to be an ingenious approach to climate action, but beneath the surface, the picture is far more convoluted.

One of the most glaring issues arises from the notion of additionality, which is central to the legitimacy of carbon offsets. Additionality posits that the carbon reduction credited should occur beyond what would have happened without the project. Unfortunately, many offset projects falter in this regard. Numerous audits reveal that projects claiming to sequester carbon were, in fact, either already underway or would have happened regardless of external funding. Essentially, this means that companies may be paying for credits that are little more than paper gains—without any real environmental benefit.

This leads to another critical concern: the integrity and transparency of the carbon markets. The landscape is rife with what might be termed “greenwashing”, where entities, under the guise of environmental stewardship, engage in practices that are, at best, ineffectual. Companies can cloak their polluting activities behind a facade of eco-friendliness, allowing them to continue business-as-usual with no substantive changes to their operations. The term carbon piracy emerges poignantly here; it signifies the appropriation of the environmental narrative without any real investment in the necessary behavioral or systemic transformations.

Additionally, consider the ethical implications of carbon offsetting. Too often, projects that claim to sequester carbon are sown in the lands of marginalized communities, displacing indigenous populations and denying them a voice. These communities, who rely on their natural resources for sustenance and cultural identity, often see their rights undermined under the guise of environmental progress. The commodification of carbon can engender a new form of colonialism, where the Global North reaps the benefits of cleaner air while the Global South bears the burden of misplaced conservation efforts. In this light, carbon piracy is not merely fraudulent; it is deeply exploitative.

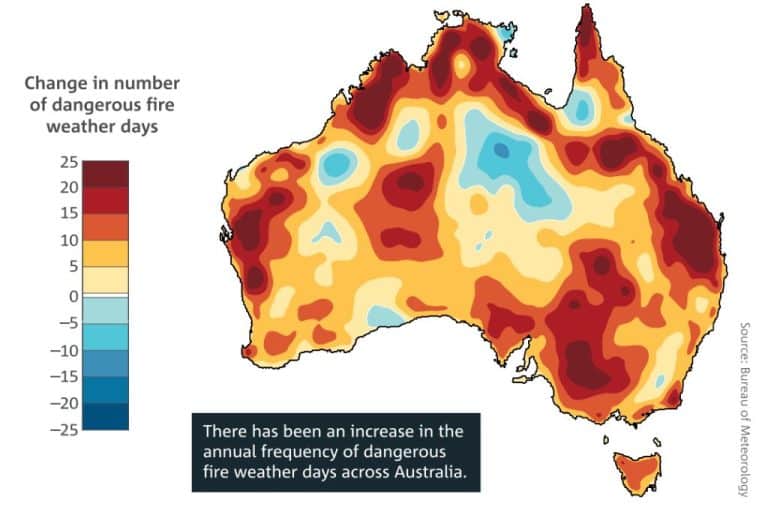

To complicate matters further, the volatility of the carbon market itself presents a myriad of challenges. Fluctuations in credit prices can lead to unpredictable funding for projects that strive to combat climate change. These uncertainties can unshackle projects from their original intent, pushing them toward short-term profit motives rather than sustainable, long-term ecological strategies. When financial interests overshadow genuine environmental concern, the promise of carbon markets diminishes alarmingly.

Furthermore, the allure of quick fixes can stymie innovation and progress. Organizations might focus intensely on purchasing credits as a remedy for their emissions instead of investing in renewable technologies or rethinking their operational structures. Instead of spearheading a genuine transition toward sustainability, they engage in a detrimental cycle of superficial compliance and neglect, effectively ignoring the urgency of the global climate crisis.

An additional layer to this narrative is the problem of accountability. In a world where carbon credits can be traded like stocks, monitoring and verifying the actual impact of these transactions become exceedingly challenging. There are numerous instances where offset projects out of compliance continue to operate, obscured by the opacity of the market. This lack of accountability allows for the proliferation of sham projects that do more harm than good, leaving the environment and vulnerable populations on the sidelines of the carbon trading game.

In light of these multifaceted issues, it becomes imperative to advocate for greater oversight and regulatory frameworks surrounding carbon credits and offsets. Governments and international bodies must assume the mantle of accountability, ensuring that all projects claiming to furnish carbon credits adhere to stringent guidelines that prioritize both environmental integrity and social justice. Furthermore, there needs to be a pronounced shift towards understanding and tackling the root causes of emissions rather than treating the symptoms through offsets. A cultural re-examination of consumption patterns and production methodologies is fundamental for lasting progress.

Public awareness and education also play a pivotal role in this recalibration. Consumers must become astute advocates for transparency within the carbon market. Understanding the distinction between offset programs that yield tangible benefits and those that serve as mere illusions is vital in galvanizing a collective effort toward genuine climate action. By demanding higher standards and scrutinizing the ethical implications of carbon trading, individuals can help mitigate the prevalence of carbon piracy.

In conclusion, carbon offsets and credits encapsulate both hope and deceit in the battle against climate change. While they may offer a semblance of a pathway to better environmental stewardship, the specter of carbon piracy casts a long shadow over their efficacy. It is essential to recognize that the promise of carbon markets is hollow unless it is sustained by honesty, rigor, and an unwavering commitment to social and environmental justice. The shifts in perspective and policy that must occur are not just beneficial; they are imperative if we are to harness the true potential of our climate initiatives and avert the calamitous future that looms ahead.

Leave a Comment