As the sun sets on the fossil fuel era, a new dawn beckons—the dawn of wind power, a renewable resource poised to revolutionize India’s energy landscape. It is akin to planting a seed in fertile soil, where the promise of growth rests not solely on the seed but on the nurturing surrounding it. This article delves deep into the multifaceted avenues available for investing in wind power in India, revealing not merely a financial venture but a commitment to a sustainable future.

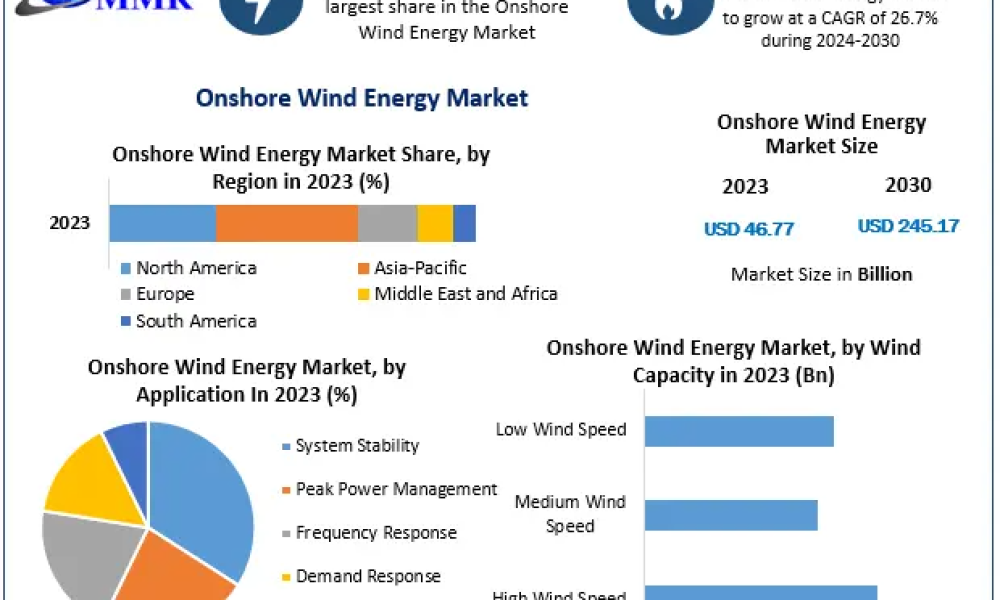

The first step in this exhilarating journey is understanding the wind power potential in India. The subcontinent, blessed with a diverse topography and a with a long coastline, offers favorable wind conditions, particularly in states like Tamil Nadu, Gujarat, and Maharashtra. This potential is akin to a blank canvas awaiting an artist’s brush; the winds whisper tales of transformation yet to unfold. According to data, India’s wind energy capacity is estimated to reach colossal figures, making it one of the top wind energy producers globally. Recognizing this impetus, investors can craft their strategies to harness these winds of change.

As one steps forward into this arena, knowledge becomes the most potent tool in the arsenal. Investors must familiarize themselves with the regulatory framework governing wind energy in India. This landscape is intricate, comprising state and central government policies that dictate everything from land acquisition to power purchase agreements. Engaging with government avenues—such as the Ministry of New and Renewable Energy—provides invaluable insights into fiscal incentives, subsidies, and the ambitious targets set for renewable energy adoption. Treasury and regulatory bodies serve as both guiding stars and steadfast anchors in navigating this initiative.

After charting the regulatory waters, aspiring investors must assess site selection meticulously. Site identification is not merely a geographical consideration; it’s a strategic play akin to choosing a prime location for a burgeoning business. Requirements such as wind speed, topography, and ecological impact must align with the investor’s vision. For instance, sites must exhibit sustained wind speeds, traditionally measured in megawatts (MW) per hour. Utilization of advanced meteorological tools can aid in gauging these vital statistics. Satellite data, an often overlooked resource, maps out wind patterns, illuminating prospective sites where turbines might harness the natural power of the environment.

Once a suitable site has been identified, the process transitions to financing the installation of wind farms, considered both an art and a science. Potential investors have several avenues at their disposal: equity financing, loans, or public-private partnerships. Each route harbors distinct merits yet carries unique risks. Equity financing provides invaluable access to capital while entrusting operational expertise to seasoned companies. Conversely, venture capital firms eager to embrace the renewable sector may offer a lifeline for innovative projects.

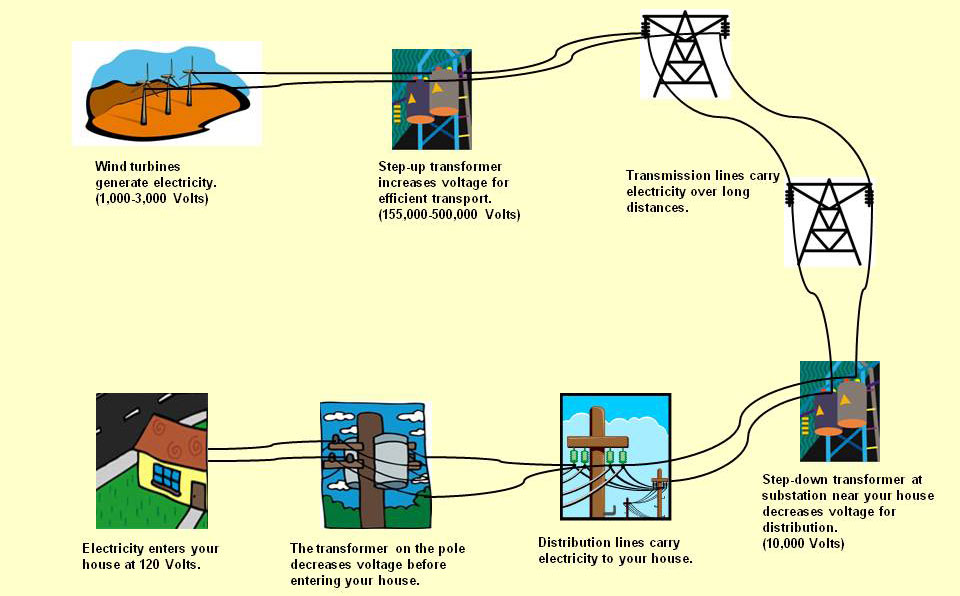

In lighting the path forward, it’s critical to maintain fidelity to technological advancements. The wind turbine industry is unremittingly evolving, akin to a river that adapts its course to the landscape through which it flows. Innovations in turbine design and energy storage solutions have made wind power increasingly viable. For instance, advancements in the capacity of turbines allow for diminished environmental footprints and increased energy generation. Engaging with technology suppliers known for their cutting-edge equipment can optimize potential returns and bolster sustainability goals.

Furthermore, harnessing financial instruments, such as green bonds and infrastructure investment trusts, can serve as auxiliary means to raise capital for wind projects. These instruments act as a bridge, connecting socially conscious investors with sustainable ventures, capitalizing on a shared ideology toward environmental stewardship. The allure lies in the dual promises of financial returns and contributing toward a greener planet, a sentiment that resonates globally in these urgent times.

No investment in wind power is complete without community engagement. The fibers of society are inextricably woven into the fabric of sustainability projects. Understanding the local community’s sentiments surrounding wind installations can either fortify or jeopardize an investment. Open dialogues can demystify misconceptions, heralding benefits through local job creation and energy cost reductions. Involving them in the decision-making process enables a shared vision—a confluence where community needs align with renewable aspirations.

As operational wind farms spin into action, continuous monitoring becomes paramount. Measuring performance metrics not only assures stakeholders of their investment’s health but is also critical for optimizing power generation. Data analytics apply a scientific lens to enhance operational efficiency, shedding light on trends that can be harnessed for future projects. Understanding seasonal variations, for instance, informs resource allocation and guides pursuits of additional projects that can maximize output.

In conclusion, investing in wind power in India demands a dexterous blend of knowledge, strategy, and responsible action. It is a symphony requiring harmonious collaboration among investors, government, local communities, and technology providers. Each move, carefully considered and executed, can create a sustainable energy future that resonates for generations. As the winds of change gather strength, now is the moment to claim a stake in this burgeoning sector, planting seeds of hope that will flourish in the onshore and offshore landscapes of India.

Leave a Comment